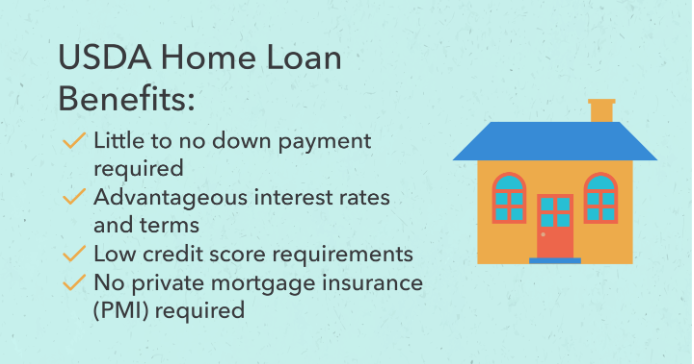

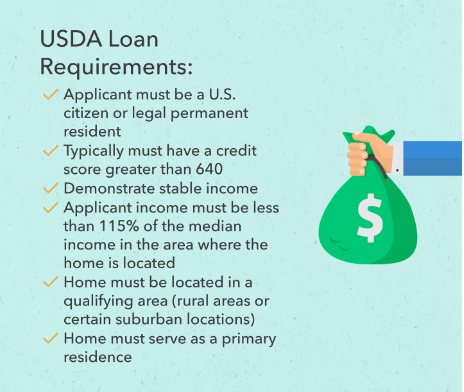

The USDA home loan program, under the United States Department of Agriculture, offers 100% financing for new home purchases, provided the property is in a USDA-targeted area. Here’s how USDA financing works:

- Loan Qualification:

Similar to FHA and VA loans, USDA insures loans meeting its qualification guidelines, with both USDA and the lending institution conducting underwriting. This dual underwriting may extend the loan process, a factor to consider for agents and lenders aiming for a quick closing.

2. Credit Requirements:

While there’s no set minimum credit score, a target of 640 or higher is recommended. USDA allows for a “manual underwrite” if the automated system results in a “not approved” status, requiring compensating factors for approval.

3. Income and Work History:

A minimum of 2 years of work history is required, potentially less if there was schooling in the previous years relevant to the area of employment.

4. Loan Amount:

USDA finances 100% of the home’s purchase price, making it a true zero-down home loan program insured by the Federal Government.

5. USDA Home Appraisal:

USDA mandates an appraisal by an approved appraiser to ensure the property meets lending standards. While not a home inspection, the appraisal may identify issues similar to a conventional appraisal.

6. Seller Concessions and Closing Costs:

USDA allows for seller concessions of up to 4% of the sales price to cover the buyer’s closing costs.

7. Closing Cost Roll-In:

If a home appraises higher than the sales price, the buyer may have the option to “roll in” closing costs into the loan, up to the difference between the appraised value and the sales price. This makes a zero-down, no-closing-cost scenario a possibility with the USDA home loan mortgage.