Tag: Mortgage

-

California Condo Prices Drop Up to 40% in Some Areas

by

Condo owners in parts of California are cutting their asking prices by up to 40% on Zillow, the real estate marketplace app. As of Wednesday morning, there are 8,476 condos listed for sale on Zillow in California. Of these, 1,973 have had their asking prices reduced. Most of these price cuts are in San Francisco,…

-

8 Types of Business Loans: Which Is Right for You in 2024?

by

in FINANCEChoosing the right business loan can be tough with so many options available. Each business has unique needs, so there’s no one-size-fits-all solution. Here’s a simple guide to help you understand the 8 most common types of business loans and how to choose the best one for your needs. 1. Term Loans Term loans are…

-

Removing FHA Mortgage Insurance: A Guide to Lowering Your Payments

For many first-time homebuyers or those with less-than-perfect credit, FHA loans have provided a path to homeownership. However, these loans come with mortgage insurance premiums (MIPs) that can be challenging to remove. Here’s what you need to know about eliminating FHA mortgage insurance and whether it’s a wise decision. Understanding FHA Mortgage Insurance FHA mortgage…

-

Inflation Hike May Put Mortgage Rates Above 7% Again

by

Article from https://www.nar.realtor By: Melissa Dittmann Tracey Consumer prices accelerated faster than expected in March, which could mean higher home financing costs this spring, says NAR Chief Economist Lawrence Yun. The latest inflation data could push mortgage rates higher, economists are saying. Consumer prices reaccelerated in March, showing a more somber picture of economic progress and…

-

Alameda County, CA Homebuyer Assistant Progam

Welcome to AC Boost! Article from AC Boost. https://www.acboost.org/ AC Boost is an innovative program designed to help middle-income households afford to buy a home in Alameda County. AC Boost gives buyers a boost, providing loans that are intended to bring homeownership within reach of households who would otherwise not be able to afford to…

-

Considering the prospect of a Second Mortgage?

by

Here’s a guide before diving into the realm of purchasing a second home. If you’re eyeing a new property while still holding onto your current one, you’re probably treading cautiously through the waters of managing two mortgages simultaneously. Balancing this scenario can be tricky for many buyers and sellers, but with some strategic maneuvering, it…

-

CALIFORNIA DREAM FOR ALL-California Program That Helps Pay for Your First House

by

Applications Open April 3 for California Program That Helps Pay for Your First House Erin Baldassari Article from KQED When it rolled out last year, the California Dream for All program — a loan application for first-time home buyers — exhausted its approximately $300 million of funding within 11 days. That prompted some changes this…

-

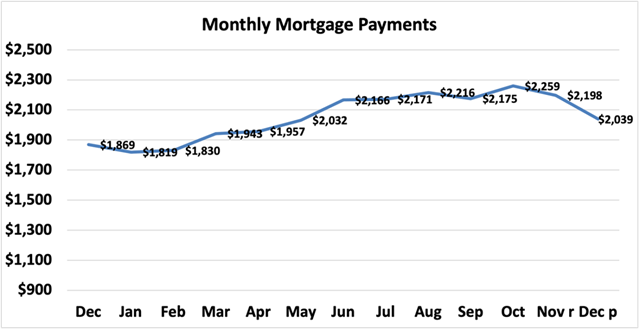

Unlocking Home Savings: How Lower Mortgage Rates Benefit Buyers

by

In the world of real estate, the spotlight is on the fluctuating dance of mortgage rates. After reaching highs not seen in over two decades in late October, the good news is they are finally on a downward trend, marking a significant shift for potential homebuyers. So, how does this translate into real savings for…

-

2024 Spring Boost In The Housing Market: Biggest Jump In 3 Years

by

Key Points: Impact on the Spring Home Shopping Season: Mortgage Rates and Seller Decisions: Home Prices and Market Dynamics: Challenges and Considerations: Buyer Activity and Market Dynamics: Final Thoughts: The housing market is experiencing positive shifts, with increased listings and buyer activity. While sellers are taking advantage of perceived mortgage rate stability, challenges in supply…

-

Credit History, Credit Scores & How It Affects Buying A Home

by

Credit Understanding for First-Time Home Buyers Comprehending your credit is a vital initial step in the home buying process. Numerous user-friendly online services, such as Equifax, Experian, and TransUnion, offer free yearly credit reports at www.annualcreditreport.com. It’s essential to obtain a credit score from each bureau, considering that scores may vary based on scoring models…