Key Points:

- Last week, the average interest rate for 30-year fixed-rate mortgages increased to 6.80% from 6.78%.

- Mortgage applications for home purchases fell by 1% compared to the previous week and were 19% lower than a year ago.

Mortgage demand is facing challenges as interest rates make a comeback, affecting especially those looking to buy homes.

What Happened:

- Mortgage applications went up by 3.7% last week, mainly due to increased refinancing activities.

- The average interest rate for 30-year fixed-rate mortgages rose to 6.80%, though this doesn’t fully capture a significant spike last Friday after a strong employment report.

- Despite lower rates earlier in the week, applications for home purchases dropped by 1%, marking a 19% decrease compared to the same week last year.

Why the Pause:

- Joel Kan, an economist, mentioned that home purchase activity has been strong in 2024, but it’s still lower than last year due to limited housing supply.

- Refinancing applications increased by 12%, with the share of refinancing in total mortgage activity rising to 35.4%.

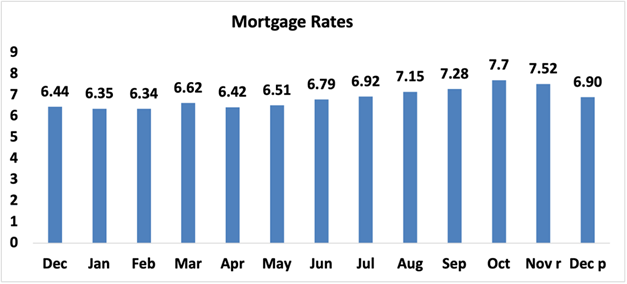

What’s Behind the Rates:

- Mortgage rates slightly decreased on Tuesday but had previously risen due to unexpected robust economic data.

- Various Federal Reserve speakers noted they still expect rate cuts in 2024, but not as quickly as the market anticipated.

In conclusion, the real estate market is seeing a slowdown in homebuyer activity as interest rates tick up. Mortgage applications for refinancing are on the rise, but potential homebuyers are cautious, partly due to the recent spike in interest rates. The coming weeks will reveal how the market adjusts to these changes.