Key Points:

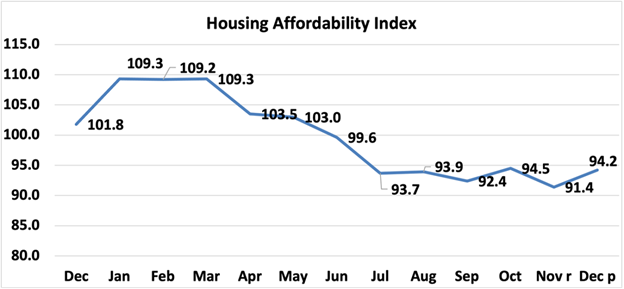

- Nationally, housing affordability got better in December, says NAR’s Housing Affordability Index.

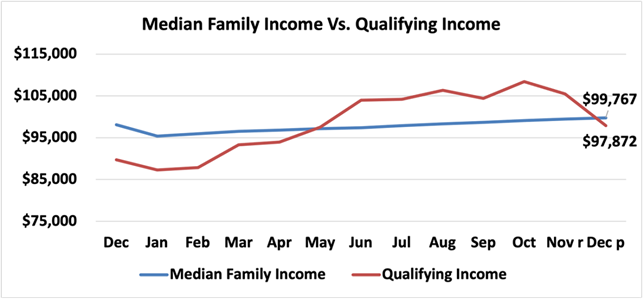

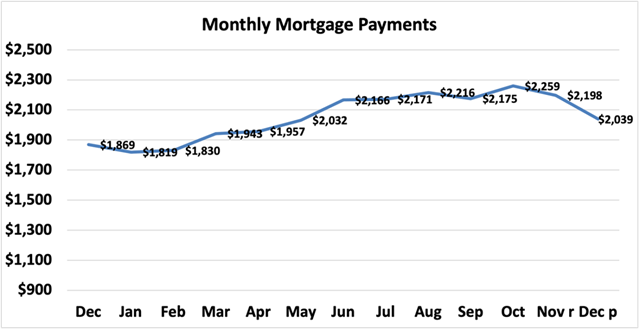

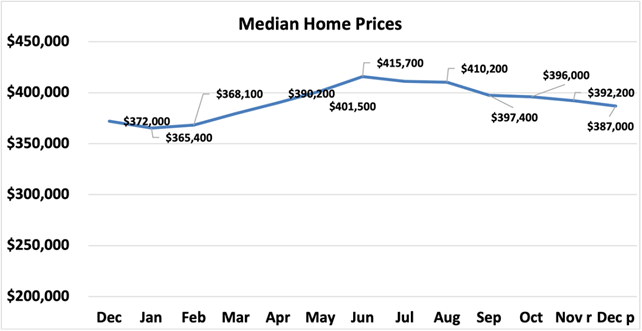

- Monthly mortgage payments dropped by 7.2%, and single-family home prices fell by 1.3%.

- Median income rose by 1.7%, but affordability was down by 9.1% compared to a year ago.

In December 2023, the U.S. saw positive changes in housing affordability, according to the National Association of Realtors (NAR).

Monthly Improvements:

- The monthly mortgage payment decreased by 7.2%, bringing relief to potential homebuyers.

- Median prices for single-family homes went down by 1.3%, making homes more accessible.

- The national index is now below 100, indicating that a family with median income finds it challenging to afford a median-priced home.

Regional Differences:

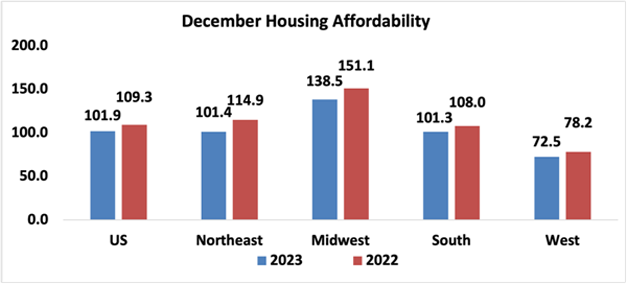

- The Midwest ranked as the most affordable region with an index value of 138.5.

- The West remained the least affordable with an index of 72.5, showing a gap in affordability.

- The Northeast and the South had intermediate affordability levels.

Yearly Changes:

- On a yearly basis, affordability decreased across all regions.

- The Northeast saw the most significant decline, followed by the Midwest, West, and the South.

Job Market and Mortgage Rates:

- The improving job market is a positive sign for the economy.

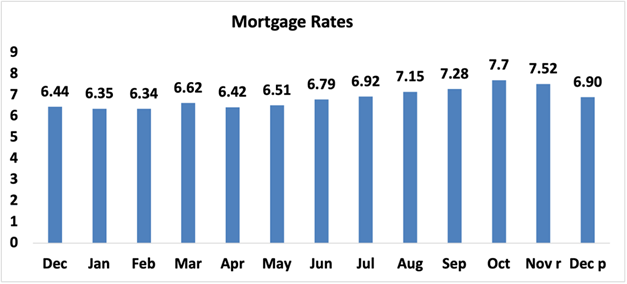

- Mortgage rates continued to decrease, easing the burden on monthly mortgage payments.

- Home price growth stabilized, creating a favorable environment for the upcoming spring homebuying season.

Final Thoughts: December brought good news for homebuyers, with improvements in affordability at the national level. While challenges persist, the positive trends in mortgage rates, job markets, and home prices offer hope for those looking to enter the housing market in the coming months.