Category: HOUSING MARKET UPDATE

-

Santa Clara County affordable housing sees huge funding drop

by

by Joyce Chu JUNE 5, 2024 Article source: https://sanjosespotlight.com/santa-clara-county-affordable-housing-sees-huge-funding-drop/ Santa Clara County received $700 million to build affordable housing last year, down from about $925 million in fiscal year 2022. State and federal funding for affordable housing took a steep drop in Santa Clara County last year, putting more of a burden on local governments to…

-

California Condo Prices Drop Up to 40% in Some Areas

by

Condo owners in parts of California are cutting their asking prices by up to 40% on Zillow, the real estate marketplace app. As of Wednesday morning, there are 8,476 condos listed for sale on Zillow in California. Of these, 1,973 have had their asking prices reduced. Most of these price cuts are in San Francisco,…

-

Rents in This East Bay City Are Dropping, Data Shows

by

While rent prices in most Bay Area cities are increasing, one East Bay city is experiencing a decline. According to data from Apartment List, Oakland’s asking rents have decreased by 10% over the past year. The data reveals that the median asking rent for a one-bedroom apartment in Oakland was around $2,400 per month in…

-

Removing FHA Mortgage Insurance: A Guide to Lowering Your Payments

For many first-time homebuyers or those with less-than-perfect credit, FHA loans have provided a path to homeownership. However, these loans come with mortgage insurance premiums (MIPs) that can be challenging to remove. Here’s what you need to know about eliminating FHA mortgage insurance and whether it’s a wise decision. Understanding FHA Mortgage Insurance FHA mortgage…

-

Janet Yellen Says It’s ‘Almost Impossible’ For First-Time Homebuyers To Enter

by

During her testimony before the House Ways and Means Committee, U.S. Treasury Secretary Janet Yellen expressed concerns about the challenges facing first-time homebuyers in the current housing market. Yellen noted that with rising house prices and higher interest rates, it has become “almost impossible” for first-time buyers to enter the market. To address this issue,…

-

Is the Bay Area’s real estate market heading towards a bubble?

by

That’s the burning question on everyone’s minds as the region grapples with unprecedented changes brought on by the COVID-19 pandemic. To shed some light on the situation, ABC7 news anchor Reggie Aqui caught up with Bay Area real estate agent Hans Struzyna. According to Struzyna, the current market landscape has left many scratching their heads…

-

Sacramento ranked as one of the state’s top 10 most overpriced markets

by

California’s real estate market remains one of the priciest in the nation, with certain areas displaying staggering levels of overpricing, according to recent housing market data analysis. Among the Golden State’s top 10 most overpriced markets is Sacramento, where the average listing price for a single-family home stands at a hefty $580,804. However, Modesto claims…

-

The Struggle of Affording Homes Today: Insights and Implications

by

Owning a home has long been a part of the American dream, but for many, that dream feels increasingly out of reach. A recent survey commissioned by Redfin sheds light on just how challenging homeownership has become, revealing that nearly 40% of current homeowners doubt they could afford their own home if they were to…

-

California home prices climb higher, but sales stall

by

Article from https://ktla.com/news/california/california-home-prices-climb-higher-but-sales-stall/ by Marc Sternfield Sales of existing single-family homes in California dipped in March as mortgage rates once again edged higher, according to new data from the California Association of Realtors. After two consecutive months of double-digit increases, statewide home sales fell by 7.8% month over month and were down 4.4% percent from March 2023 on a…

-

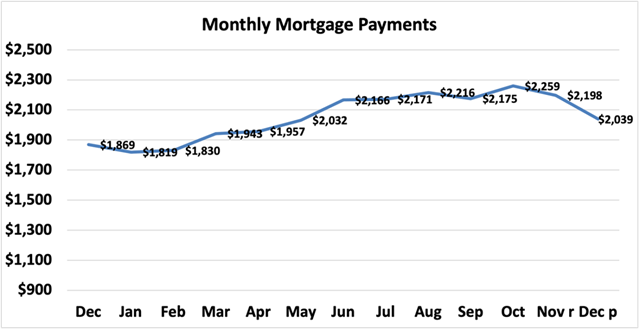

Inflation Hike May Put Mortgage Rates Above 7% Again

by

Article from https://www.nar.realtor By: Melissa Dittmann Tracey Consumer prices accelerated faster than expected in March, which could mean higher home financing costs this spring, says NAR Chief Economist Lawrence Yun. The latest inflation data could push mortgage rates higher, economists are saying. Consumer prices reaccelerated in March, showing a more somber picture of economic progress and…