Category: HOME BUYER GUIDE

-

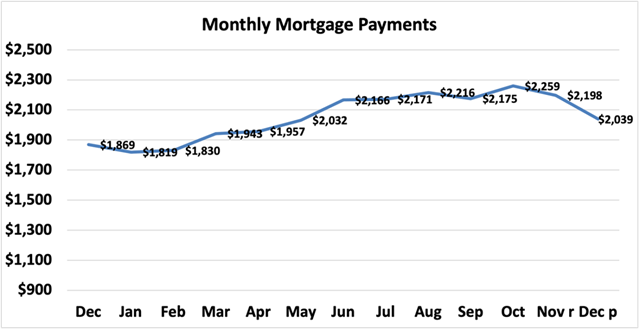

Removing FHA Mortgage Insurance: A Guide to Lowering Your Payments

For many first-time homebuyers or those with less-than-perfect credit, FHA loans have provided a path to homeownership. However, these loans come with mortgage insurance premiums (MIPs) that can be challenging to remove. Here’s what you need to know about eliminating FHA mortgage insurance and whether it’s a wise decision. Understanding FHA Mortgage Insurance FHA mortgage…

-

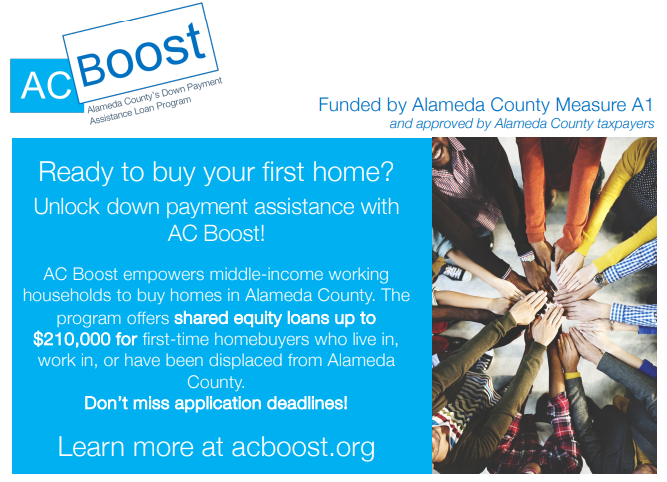

Exciting News for Potential Homebuyers in Alameda County!

Are you dreaming of owning your own home in Alameda County but struggling to make the down payment? Well, you’re in luck! Applications are now open for the final round of down-payment assistance funds through AC Boost, Alameda County’s homebuyer assistance program. Here’s what you need to know: What is AC Boost? AC Boost provides…

-

Alameda County, CA Homebuyer Assistant Progam

Welcome to AC Boost! Article from AC Boost. https://www.acboost.org/ AC Boost is an innovative program designed to help middle-income households afford to buy a home in Alameda County. AC Boost gives buyers a boost, providing loans that are intended to bring homeownership within reach of households who would otherwise not be able to afford to…

-

First-Time Homebuyer Tips From Real Estate Pro

by

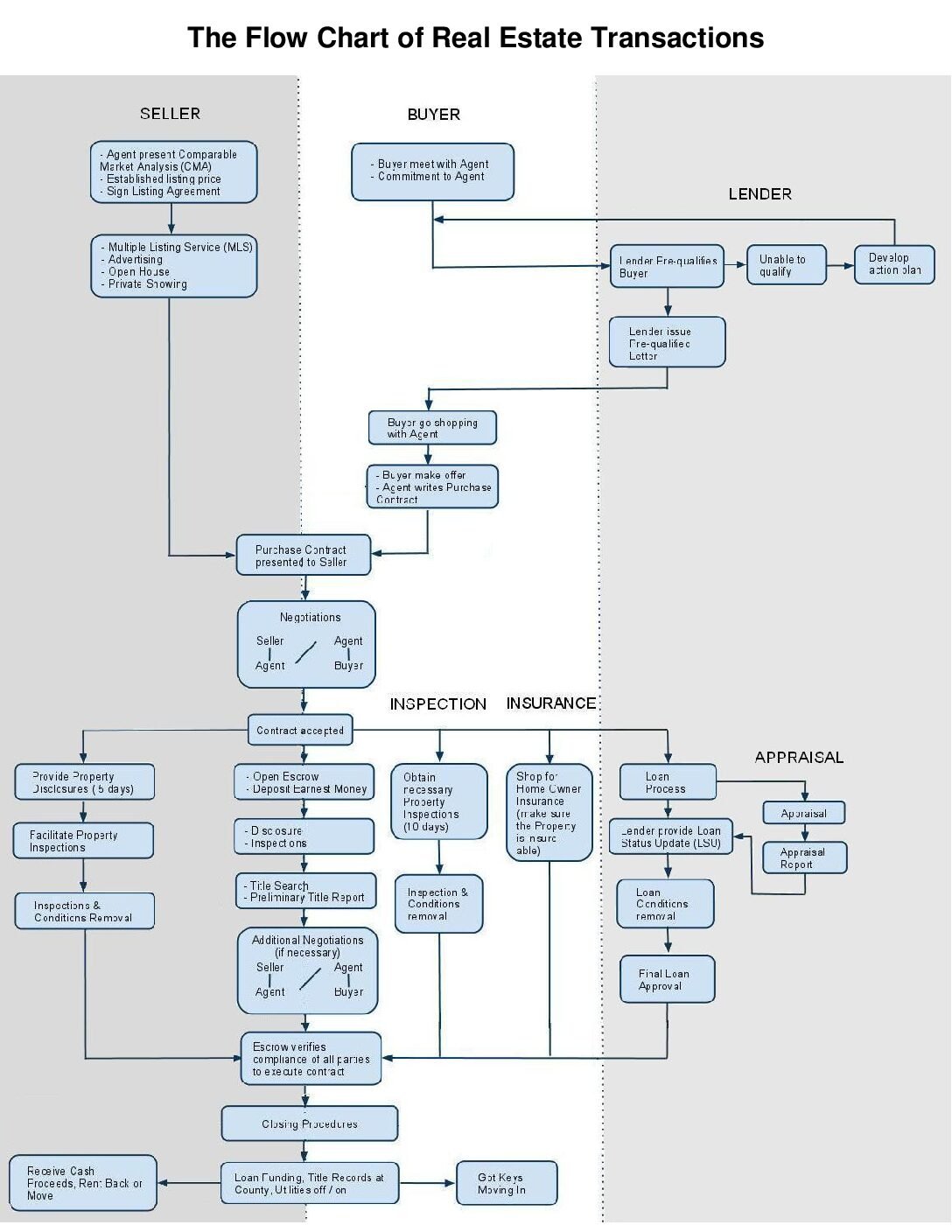

Looking to buy your first home? It’s an exciting journey, but it can also be overwhelming. Don’t worry, though. We’ve got you covered with advice from real estate pros to help you navigate every step of the process. Sorting Out Your Finances First things first, let’s talk money. Understanding your financial situation is key. Meeting…

-

What Does “Contingent” Mean in Real Estate?

by

Learn more about common contingencies in real estate and how they can affect the buying processes. Buying and selling a home often requires a dictionary as you navigate a new litany of terms, each describing a crucial step in the process. In real estate, a contingent offer has a meaning all its own—one that can make or…

-

-

Empower Homebuyers In Santa Clara County

We believe communities prosper when people can own a home in places that matter to them. Article From https://housingtrustsv.org/ With housing costs so high, many of our friends, families, colleagues, and neighbors in the greater Bay Area cannot afford to purchase a home here, because securing a down payment is out of reach. In San…

-

Guide for First-Time Home Buyers: Making Your Dream Home a Reality

by

Thinking of buying your first home? It’s an exciting journey, and we’ve got some helpful tips to guide you through the process—before, during, and after your purchase. Before You Buy: Finding Your Dream Home: During the Buying Period: Post Purchase: Buying your first home is a significant step, and with these tips, we hope you…

-

VA HOME LOAN 100% FINANCINGPROGRAMS

by

The VA home loan, provided through the Veterans Benefits Administration under the Department of Veteran Affairs, offers 100% financing for zero-down home buying. Military members, veterans, and eligible family members may qualify for a new home loan with little or no down payment, subject to eligibility criteria and the possession of a Certificate of Eligibility…

-

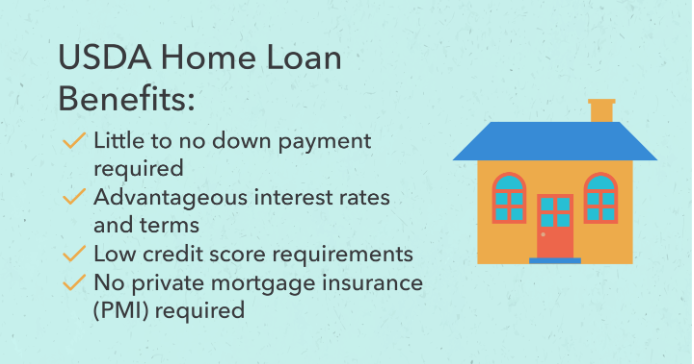

USDA 100% HOME LOAN PROGRAMS

by

The USDA home loan program, under the United States Department of Agriculture, offers 100% financing for new home purchases, provided the property is in a USDA-targeted area. Here’s how USDA financing works: Similar to FHA and VA loans, USDA insures loans meeting its qualification guidelines, with both USDA and the lending institution conducting underwriting. This…